About us

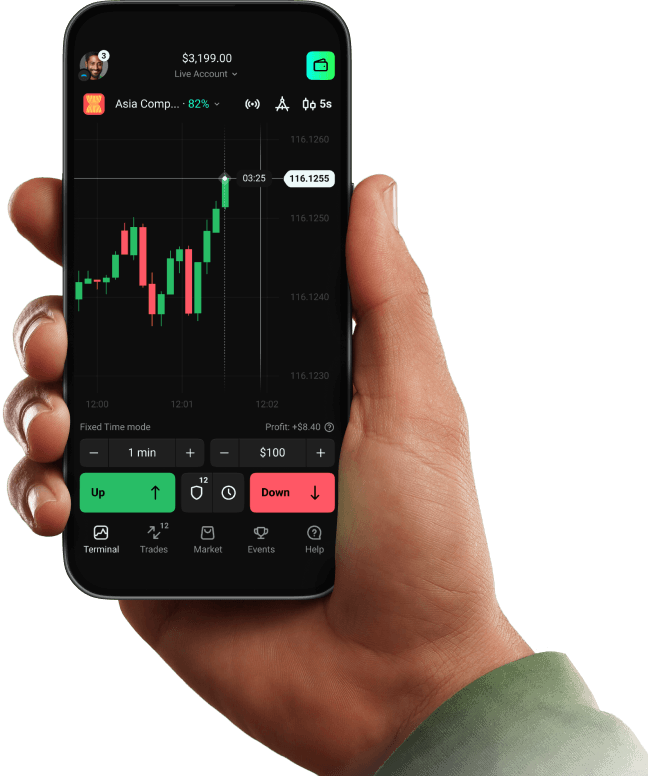

10 years of empowering traders. Since 2014 we’ve been providing smooth

trading for over 100M users from 130+ countries

1M+

daily transactions

on the platform

We empower people all over the world to realize their right to a better life. Every year, we provide essential support and resources to those in need

Olymptrade is a licensed and

regulated online broker

FAQ

If you couldn’t find an answer to your question, our 24/7 support team will be happy to help you.

Can I actually earn money with Olymptrade?

Yes, you can. If your price forecasts are more often correct than not, you will be making a profit.

Is trading with Olymptrade safe?

Yes. Olymptrade operates in a regulated environment and provides the risk mitigation tools necessary to make trading on our platform as safe as possible.

Is Olymptrade gambling?

No, it’s not. Olymptrade is an online trading platform where users can earn money by opening and closing trades, utilizing their knowledge and experience with trade instruments to analyze assets’ price movements.